The State Bank of India (SBI) has reported that Foreign Portfolio Investors (FPIs) have had a significant impact on key sectors such as financial services, oil & gas, and automobiles due to continued selling pressure.

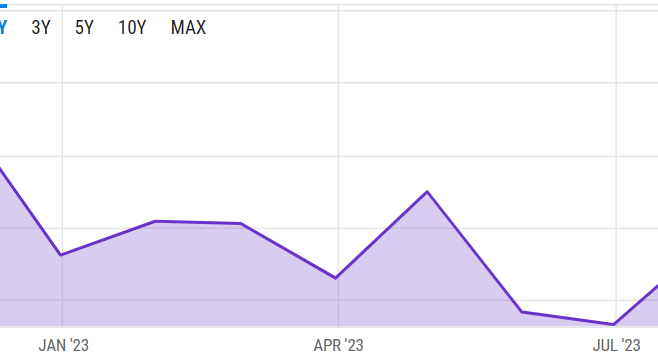

In the first half of October, there were considerable outflows, which marked a sharp reversal from previous trends.

The financial services sector experienced the highest FPI outflows amounting to Rs 23,283 crore. This starkly contrasted with September when FPIs had invested Rs 27,200 crore in the same sector. The report indicates that foreign investors are adopting a cautious approach toward the Indian market, particularly in the financial sector.

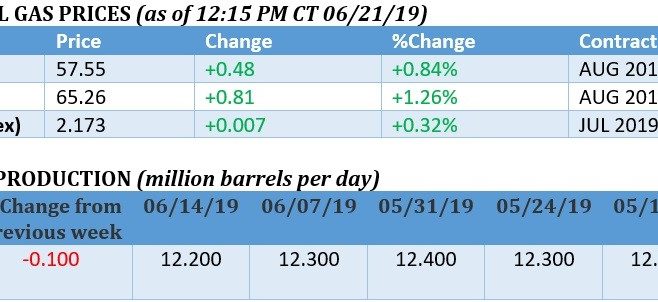

The oil, gas, and consumable fuels sectors also suffered significant outflows of Rs 12,371 crore. Similarly affected was the automobile and auto components sector with outflows amounting to Rs 8,131 crore in October. The report highlighted that most sectors failed to attract significant FPI inflows during this period.

One exception was the chemicals sector which saw modest FPI inflows of Rs 552 crore – marking it as having received the highest inflow among all sectors.

This data underscores growing concerns among foreign investors regarding India’s current economic outlook, particularly in sectors sensitive to global market fluctuations. It is noted that continued selling by FPIs may affect market sentiment and create further volatility in these key sectors.

October has recorded historic levels of FPI outflows with foreign investors having sold a net Rs 77,701 crore in equities so far this month – surpassing even the COVID-19-induced sell-off of March 202 when Rs61,972.75 crore was offloaded.

This makes October a historic month for heavy selling pressure by FPIs and signals an unprecedented level of caution from foreign investors towards Indian markets amidst ongoing economic challenges globally.